Prosus (PROSY) - Company Analysis as of 01/26

Everything You Didn’t Want to Know About the Company But Were Too Smart Not to Ask

Note: The data in this report is provided ‘as-is’ as of January 31, 2026 and may not be entirely complete, or up-to-date. There has been significant market volatility between the report date and the date published on Substack.

Executive Summary

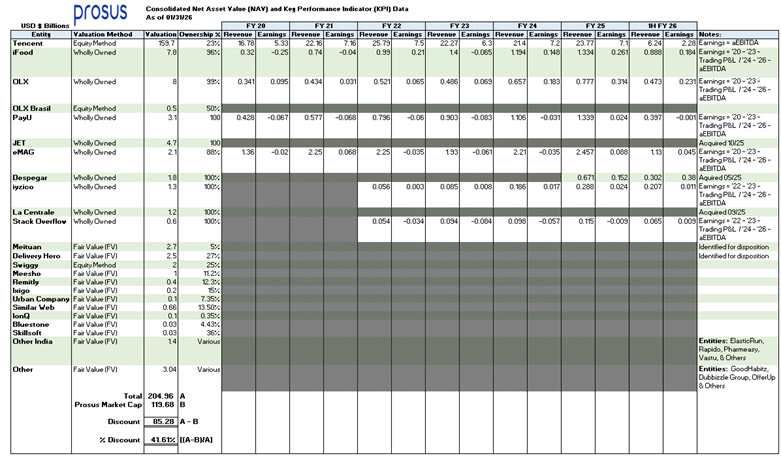

We believe Prosus is at a fundamental turning point as its consolidated portfolio pivots from a “growth at any cost model[1]” to a high margin, earnings generative engine. Despite having a diversified technology centric portfolio with a Net Asset Value (NAV) of approximately $205 billion, the market continues to apply a punitive “conglomerate discount”, with the current market cap sitting at $120 billion. The discount provides an attractive entry point with significant margin of safety[2]. We expect this 42% discount to NAV to compress as the market re-rates Prosus’s non-Tencent assets, of which many are primed for significant growth in the near term.

Key Catalysts

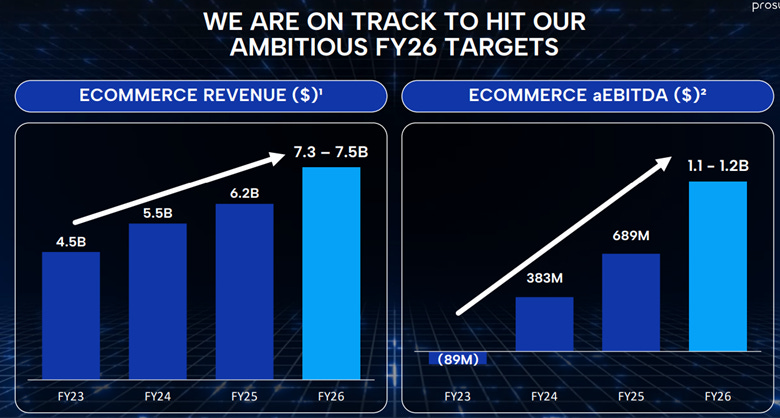

· Inflection Point in Ecommerce: Historically, Prosus used dividends and sales of Tencent stock to fund loss-making acquisitions. This is no longer the case. As of 2025, all wholly owned subsidiaries are EBITDA[3] positive. Core EBITDA (ex. Tencent) is expected to almost triple between FY 2025 ($430 million) and FY 2026 ($1.1 billion).

· Multiple Expansion Potential: Prosus currently trades at a depressed 10x-14x earnings multiple. Given the shift toward profitable growth and the potential for its technology portfolio to be re-evaluated as high quality, we view a re-rating toward a 20x-30x multiple as achievable, aligning Prosus with global peer benchmarks.

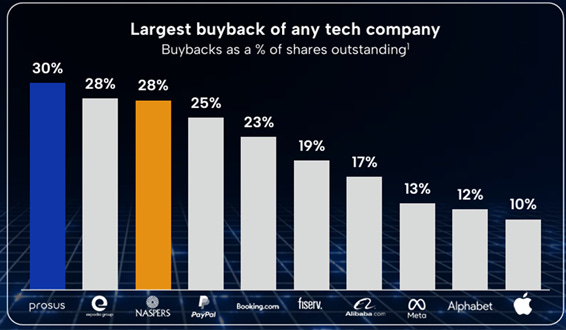

· Aggressive Capital Allocation: The company has demonstrated a robust commitment to shareholder returns, having repurchased 30% of outstanding shares over the last five years. This is particularly powerful given that Prosus’s shares trade at a significant discount to their NAV. This ongoing buyback program provides a significant floor for the share price and can significantly enhance EPS growth.

Risk Factors

While the fundamental story is strengthening, investors should remain cognizant of geopolitical and macroeconomic risks, particularly given the company’s heavy exposure to China, Brazil, and India. Additionally, large recent acquisitions, such as Just Eat Takeaway, introduces heightened execution risk as management seeks to integrate these assets into the existing portfolio and realize projected synergies which may not materialize or take longer/cost more than expected. A global economic slowdown could curtail discretionary consumer spending across its platform leading to lower revenue and EBITDA.

NAV Calculation and Performance Data

How to Read this Report

This report provides a deep dive into Prosus, covering its corporate structure, strategic roadmap, subsidiary companies, and its extensive investment portfolio. Since it’s quite dense, casual readers looking for a quick brief on the company are advised to focus on these specific sections:

· Overall Thesis

· The Contra Thesis

· Tencent section

· The Wholly Owned Subsidiaries section

· Balance Sheet and Capital Allocation

· Artificial Intelligence

· Risk Factors

· Conclusion

Overall Thesis

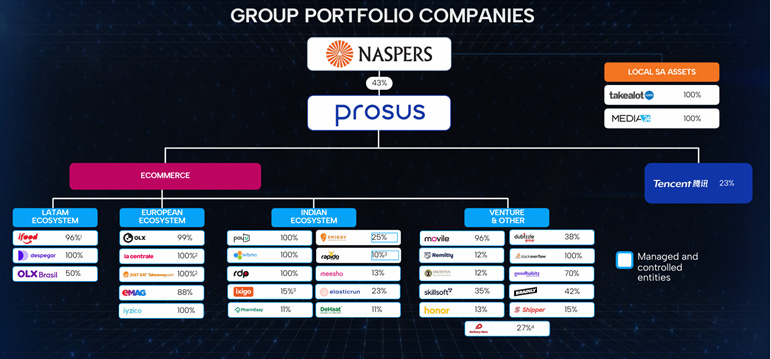

Prosus operates as a global consumer internet group and is one of the largest technology investment companies in the world. To systematically analyze the company, we will break it down into 4 distinct groupings of assets:

· Tencent: Tencent is a Chinese multinational technology conglomerate. The value of Prosus’s 23% ownership stake in this single position exceeds its entire market cap[4]. Tencent itself trades at a significant discount to its own NAV[5], creating a “double discount” and additional embedded value for Prosus investors.

· Core Operating Subsidiaries (Wholly Owned): Prosus maintains 80%-100% ownership of a diversified portfolio of core internet businesses, all of which are now profitable on an EBITDA basis[6]. These companies operate in three key geographies Europe, Latin America, and India, and their businesses span high-growth sectors including:

o Payments & Fintech

o Food Delivery

o Online Classifieds

o Experiences and other ventures

· Public/Pre-IPO Equity Investments: The portfolio includes material minority stakes (5% - 20%) in emerging and mature technology companies that are either publicly traded or nearing an IPO. Many of these companies have been backed by Prosus since their early days as small startups and are part of the company’s broader regional strategy (especially in India).

· Venture Capital (Early Stage): Prosus operates an active venture arm, deploying smaller, strategic investments (typically in the $5 million-$50 million range) into promising global technology startups during early-stage funding rounds. This ensures a pipeline of future growth opportunities in areas of strategic focus. Prosus has a portfolio of hundreds of companies at various stages of their development lifecycle. In 2025 Prosus made $400 million of venture investments in 40 different companies.

Prosus shares continue to trade at a substantial discount to our estimated sum of the parts valuation. Despite having a diversified, high-quality, technology centric portfolio, the market continues to apply a punitive “conglomerate discount”. We believe the sustained valuation gap was reflective of skepticism around prior managements capital allocation and acquisition strategies of non-Tencent assets (the previous long time CEO Bob van Dijk left the company in September of 2023).

Prosus (and its parent company Naspers) initially held a 46.5% stake in Tencent, which they have been selling over the years to repurchase shares and fund acquisitions. While the portfolio companies they acquired demonstrated robust top line performance, frequently achieving > 20% YoY revenue growth, they consistently operated at a net loss, contributing to concerns regarding the portfolios quality and whether there really was a defined path to profitability for many of these companies.

We believe recent strategic shifts signal a potential inflection point for the firm’s valuation, driven by a change in leadership and clear path to profitability:

· New Leadership & Strategic Alignment: The appointment of Fabricio Bloisi as CEO of Prosus in July 2024, marked a major turning point for the company. Previously he was the CEO of a key subsidiary iFood, transforming the company into the leading food delivery app in Brazil. Bloisi brings deep operational expertise in the e-commerce sector. This experience is being leveraged to implement a cohesive strategy across the portfolio, aiming to foster synergistic “super app” ecosystems, bundling many products/services (food delivery, fintech, ecommerce, travel/experiences), across the geographies they operate in (Europe, Latin America, India). While the “super app” objective is ambitious, and it remains to be seen how successful they will be, Prosus’s portfolio of companies are poised to generate substantial earnings as standalone companies as they achieve scale. Bloisi has set ambitious long term goals for the group which we feel are achievable.

· Rapid EBITDA Expansion: Prosus demonstrates strong operating leverage and an accelerated path to profitability in its core portfolio (ex-Tencent).

o FY 2025 - $430 million

o 1st Half 2026 - $530 million

o Full FY 2026 - $1.1 billion (est.)

· Aggressive Capital Allocation: In the past Prosus (and its parent company Naspers) engaged in complex financial engineering schemes to try and eliminate/reduce the NAV discount, which often made things worse[7]. Since 2024 the company’s capital allocation has been excellent. Prosus has repurchased 30% of its outstanding shares over the last five years. This is particularly powerful given that Prosus’s shares have been trading at such a significant discount to their NAV. This ongoing buyback program provides a significant floor for the share price and can significantly enhance EPS growth.

In 2025 Prosus (PROSY) shares returned 56.26% while Tencent (TCEHY) shares returned 43.86%. The NAV discount is narrowing but a significant gap remains. This represents an attractive entry point for investors with significant margin of safety. While we believe the stock could achieve a significantly higher earnings multiple over time, were that not to happen, the company is poised to achieve higher organic earnings growth in the near term and beyond, which should propel the stock higher on its own. This coupled with the aggressive share repurchases below intrinsic value provide a substantial tailwind[8]. When you layer in the high convexity ‘lottery ticket’ optionality of the venture capital portfolio[9], the potential for outsized returns remains high.

Contra Thesis[10]

The investment thesis for Prosus is flawed due to its reliance on Tencent, a single, geopolitically sensitive asset. While management highlights the “double discount” (Prosus trading at a discount to Tencent which is itself undervalued), this structure is a permanent feature rather than a temporary bug. Prosus’s wholly owned subsidiaries remain a collection of high risk, largely unprofitable, and/or low margin e-commerce assets in volatile and competitive emerging markets. Prosus is unlikely to be successful in narrowing its NAV discount due to the following:

· Geopolitical Risk: The core or Prosus’s value is tied to the Chinese tech sector, which remains under the shadow of sudden regulatory shifts. In 2020 China initiated a “Common Prosperity” campaign and Tencent received fines, antitrust regulation, gaming restrictions, and other punitive actions. China seems to have made peace with its tech sector for now, but that could change quickly.

· Tencent Concentration: Tencent dictates Prosus’s stock price direction. Any improvements in Prosus’s own portfolio will get “drowned out” by Tencent’s performance.

· Long Term Sustainability: The transition from growth to profitability is underway with its subsidiary companies but sustainability remains unproven over a full economic cycle.

· AI Disruption: While AI presents large opportunities for Prosus and Tencent respectively, the risks of AI disruption remain a large threat as well. Market uncertainty and the risk of malinvestment in AI could negatively affect both companies in the near and long term.

Considering the above, the NAV discount may not be a market error. It could represent a rational deduction for several visible risks (geopolitical, regulatory, concentration, and execution), and the lack of a clear catalyst for Prosus to unlock the value of its portfolio.

General Company Background Information

Naspers, a 110-year-old South African traditional media giant, spent decades as a sleepy and relatively stagnant company focused on local print media, radio, and television. This changed in 1997 when Koos Bekker became CEO and pivoted the company toward global technology and internet investments. Their 2001 acquisition of a 46.5% stake in Tencent for just $32 million is now legendary and widely regarded as one of the greatest venture capital investments of all time.

At the time of investment, Tencent was an unknown, tiny startup with 45 employees, $6 million in revenue, and $1.2 million in net income. Today it is a global tech titan with over 110,000 employees, annual revenue of $91.8 billion, and net income of $27.3 billion[11].

In 2019, Naspers spun off Prosus, listing it on the Amsterdam stock exchange. Prosus houses the groups remaining stake in Tencent (23%) and other international technology assets. Naspers maintains a controlling interest in Prosus (43%), and Fabricio Bloisi serves as the Group CEO for both Naspers and Prosus following his appointment in July 2024.

Prior to Bloisi’s appointment, Naspers and Prosus engaged in several financial engineering strategies to try to reduce the NAV discount. In 2021, in a complex move, Prosus launched a voluntary exchange offer to acquire 45.4% of Naspers. This created a “cross-holding” structure where Naspers owned about 60% of Prosus, while Prosus simultaneously owned 49% of Naspers. This structure frustrated analysts, confused investors, and did little to reduce the NAV discount. The cross-holding structure was eventually unwound in September 2023.

Beyond poor capital allocation, Prosus management had historically funneled Tencent dividends and divestment proceeds into chronically unprofitable acquisitions, with Education Technology (EdTech) proving particularly disastrous. One investment, Byju, resulted in a total write-off of its $2.6 billion carrying value in June 2024. Similarly, Stack Overflow (an investment they still retain) has faced massive impairments, with at least $1.2 billion of the original $1.8 billion investment written off. While Prosus remains invested in several EdTech businesses (Goodhabitz, Skillsoft, Brainly), current management seems to be strategically pivoting away from EdTech as a primary growth engine. We believe future capital allocation to this sector will be minimal.

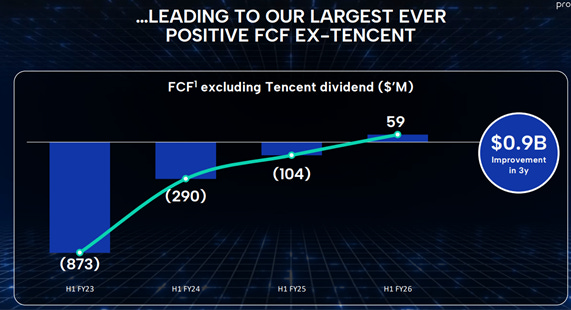

Prosus has concentrated their efforts on five core sectors (food, fintech, classifieds, travel, and experiences) within the hubs of Latin America, India and Europe. This operational pivot is already yielding record breaking results. The first half of 2026 marked Prosus’s first period of positive free cash flow (excluding Tencent[12]), consolidated ecommerce revenue increased 22%, and consolidated EBITDA surged 70%, respectively YoY. This data provides compelling evidence of proof of concept for Bloisi’s ecosystem strategy. If he can successfully integrate the large investments made in 2025[13] we would expect to see sustained growth and profitability for the company.

Aside from his short-term tactical plans for Prosus, Bloisi’s long term vision is to transform the company into a leading global technology operator. He set the ambitious goal of driving Prosus’s market cap to $200 billion, 2x revenue ($7.2 billion), and 3.5x EBITDA ($1.86 billion) by June 30, 2028. As we estimated Prosus’s current NAV at over $200 billion we view this as realistic and achievable. The Board of Directors has incentivized Bloisi with a $100 million (stock based) bonus package to be paid in 2029 if he meets two conditions[14] (simultaneously):

· Double the Market Capitalization: The group’s aggregate market value must grow from its July 1, 2024, baseline of $84 billion to at least $168 billion by mid-2028, and this value must be maintained for a full year.

· Peer Outperformance: The group’s total shareholder return must exceed the 50th percentile of a global tech peer group that includes giants like Alphabet, Meta, Amazon, and Mercado Libre.

The Ecosystem Model

Prosus is bundling it’s subsidiary (and equity investment) companies products and services together into lifestyle ecommerce systems or super app[15] offerings. They are focusing on three key regional ecosystems; Latin America, Europe, and India.

By integrating complimentary products/services (payments, food delivery, travel, ride hailing, ecommerce, etc.) into unified product offerings, Prosus hopes to grow in size/scale[16], expand to new verticals, drive volume and profit growth on its platforms, while providing value to customers and boosting their loyalty. This approach leverages a scale economies shared business model resulting in higher sales volumes for the business, and cost savings to customers[17].

Tencent

Current Valuation: $160 billion

In our opinion Tencent is one of the highest quality companies in the world. Like Prosus, Tencent is a global technology conglomerate that operates through a web of wholly owned subsidiaries, majority owned companies, and significant minority investments. While a whole report could be written on Tencent alone, for brevities sake we will limit our explanations to three categories: (1) Core Business Divisions (2) Major Global Subsidiaries (Full or Majority Ownership) (3) Significant Strategic Investments

(1) Core Business Divisions – Internal divisions that function as the backbone of Tencent’s operations.

· Interactive Entertainment Group (IEG): Manages Tencent Games, the world’s largest video game vendor.

· Platform & Content Group (PCG): Responsible for content and social media platforms including social media platforms like QQ (532 million monthly active users) and media services like Tencent Video (500 million monthly active users).

· Cloud & Smart Industries Group (CSIG): Operates Tencent Cloud, a major cloud service provider expanding rapidly in Asia, Europe, and the Middle East. Ranked 8th globally with 2% market share, and 10-15% market share in China.

· Weixin Group (WXG): Manages WeChat (1.4 billion monthly active users), the super app that integrates messaging, social media, payments and “Mini Programs” [18].

(2) Major Global Subsidiaries (Full or Majority Ownership) – Tencent fully owns or holds controlling stakes in several high-quality companies.

· Riot Games (100%): Game developer behind the popular titles League of Legends and Valorant.

· Supercell (84%): Mobile game studio behind hits like Clash of Clans and Brawl Stars.

· Tencent Music Entertainment (50%): A publicly traded company (NYSE: TME) that operates China’s leading music apps like QQ Musica, Kugou, and WeSing. While TME’s revenue, net income, and EPS have been stable and growing, the stock is down 20% over the past 6 months due primarily to disruption fears in the music space from rivals like ByteDance.

· Funcom: Game developer behind the popular game Conan Exiles.

(3) Significant Strategic Investments - In addition to being skilled operators, Tencent are incredibly astute investors as well. As of 2020 Tencent had made more than 800 investments in a wide variety of companies and over 160 had achieved “unicorn” status[19]. Other investments include:

· Epic Games (40%): Creators of the hugely popular Fortnite and Unreal Engine

· Spotify (9%): The Streaming media platform

· JD.Com (2.3%): China’s largest retailer by revenue

China vs the US in AI

Chinese AI firms currently face significant hardware disadvantages compared to their US counterparts due to export restrictions on EUV lithography equipment needed to make leading edge chips, and the (lack of access to) most advanced GPU and ASIC chips themselves[20]. This hardware is critical in being able to continue scale LLM’s. As a result of these constraints Chinese companies have excelled at optimization and cost efficiency, developing models at a fraction of the cost, using less advanced chips[21]. Chinese models deliver comparable performance, using less tokens[22] per task, often offering 70%-90% lower API costs as compared to leading US LLM’s. The Chinese AI sector maintains a highly agile development pace, closing technical gaps with US industry leaders in a matter of weeks through rapid product iteration and resourceful engineering[23].

AI consumes incredibly vast amounts of energy due to the massive computing power needed to train and run (inference) large models. Data centers need constant cooling for their hardware amplifying the consumption. AI energy usage more than tripled between 2014 and 2023. China maintains a significant structural advantage in the AI race through its centralized, state-run energy system, which produces electricity at roughly half the cost of the United States[24]. Since 2021, China has built more power generation capacity than the entire US grid in aggregate. In 2025 alone China added 543 GW of new capacity, the equivalent of 43% of the US grid. In contrast the US grid remains a fragmented patchwork of private markets and regulators. Access to affordable and reliable energy now acts as the primary bottleneck for the rapid scaling of AI data centers in the US.

Chinese open-source AI models have seen massive global adoption recently. Usage surged from 1.2% to 30% of the worldwide AI market[25] in 2025. Chinese models are seen as being developer friendly, offer comparable performance, and are lower cost alternatives to US models. Chinas strategy with AI might be to “suck the air out of the room” to create a price ceiling for AI that US companies cannot compete with due to their higher input costs. This has already happened in solar panels, electric vehicle batteries, and rare earth minerals. As of early 2026, the US is considering legislative bans or restrictions on Chinese LLMs for federal and potentially broader use, a move that would force a complex geopolitical choice for Europe and the rest of the world as they weigh digital sovereignty against significant cost advantages.

Tencent and AI

Like other major technology companies, Tencent is making significant investments in artificial intelligence. The company utilizes a two pronged strategy where they are investing heavily in their own models (especially their full stack Hunyuan LLM), while remaining “model agnostic” (like Amazon) to the use of other LLM’s within its ecosystem[26]. By committing billions of dollars to AI infrastructure investments and leveraging its massive existing user base across its existing products (like Google), Tencent is deeply embedding its AI into WeChat, gaming, and cloud services to enhance productivity, refine advertising and other targeted offerings, and drive higher user engagement.

Tencent’s AI chatbot Yuanbao (powered by its Hunyuan) model had 32 million monthly active users (as of 09/25) ranking it among the top AI applications in China, but trailing competitors ByteDance, Doubao, and DeepSeek. In AI cloud services Tencent held 7% market share of China’s market behind Alibaba Cloud (35.8%), and ByteDance Volcano (14.8%).

As of 2025 Tencent is battling with Alibaba (Qwen LLM) and DeepSeek in the large model race. While Tencent is competitive, like the US, its unclear who will emerge as the single dominant market leader in China[27].

Tencent’s Full Stack in AI

When people talk about “full stack” with regards to AI they mean complete vertical integration from having customized hardware, data centers, advanced models, and then the consumer and enterprise facing applications built on top of them.

The foundation of Tencent’s stack is its infrastructure layer in which leverages its existing cloud service provider business as a base, helping to amortize costs. Tencent optimizes its existing inventory of high-end chips through software and utilizes custom-designed domestic semiconductors.

At the model layer they have their flagship Hunyuan LLM, and more specialized models for 3d world creation, music creation, and image editing (among others). They also have a suite of smaller more efficient open-source models that they make open to outside developers in their ecosystem.

At the platform layer Tencent has a whole suite of software products for both experts and non-technical users. Their CodeBuddy tool is code writing software that can automate the entire software development process from product design to deployment. AI Builder can be used to “vibe code[28]” WeChat mini-programs. Tencent has many other software products at the platform layer.

The application layer is the top of the stack. These are the real-world tools consisting of:

· AI Agents that can perform research and perform tasks

· Provide features embedded in applications like chat suggestions, content personalization and filtering

· Specialized industry solutions for individual sectors like healthcare, finance, and gaming

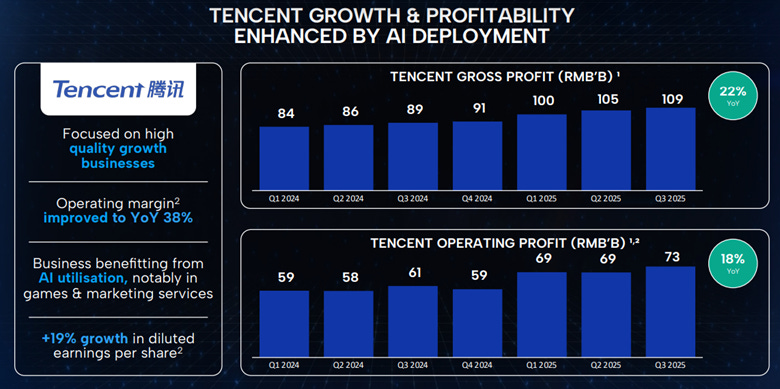

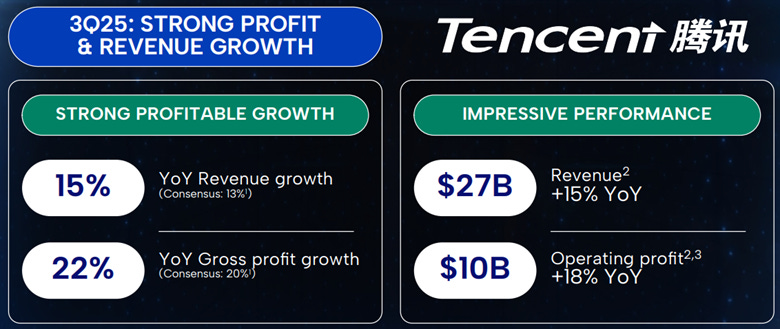

Financial Performance and Capital Allocation

Tencent’s financial performance has remained strong. As of Q3 2025 revenue for the 9 month period was $101.15 billion representing a 13.2% increase YoY. Net income for the same period was $30.21 billion, a 27.8% increase YoY.

Recently Tencent’s capital allocation strategy has focused on record high capital returns to shareholders and on a disciplined AI focused investment strategy. Management is actively working to narrow its own gap between its market price and intrinsic value. In 2025 Tencent repurchased around 147 million of its shares for $9.77 billion. Since 2022 it has repurchased 4.33% of its outstanding shares. Tencent boosted its dividend by 40% totaling $5.44 billion in payments for 2025. Tencent is currently in a high capex spending cycle to defend its competitive advantages from emerging AI competitors. It spent roughly $10-11 billion annually in 2024 and 2025 to fund development of its LLM’s like Hunyuan to compete directly with Alibaba and DeepSeek. Even with these significant, capital-intensive investments, it has remained free cash flow positive through all three quarters of 2025, producing $6.93 billion of free cash flow on average.

Prosus’s Future Plans for Tencent

“Tencent remains a cornerstone of our portfolio and is recognized as one of the world’s leading technology companies. We believe it is exceptionally well positioned to capitalize on the AI revolution, thanks to its robust ecosystem, which consistently delivers outstanding returns. Our significant stake in Tencent will be maintained for the foreseeable future[29].” We believe that Prosus’s investment in Tencent will not drop below 20% (currently at 23%), a level deemed to be “significant influence” and the threshold for equity investment treatment in it’s financial statements[30]. Even with the possible 20% red line, the additional 3% of Tencent share sales could provide Prosus with an additional $22 billion of capital to deploy for investments, acquisitions, and/or repurchases, over the next few years[31]. Between 2021-2024 Prosus sold about 2% of its Tencent stake in each of those years. We expect this trend to continue. Prosus’s Tencent investment is currently valued at $160 billion.

Wholly Owned Subsidiaries

In this section we detail the core of Prosus’s consolidated portfolio of wholly owned subsidiaries. These high conviction assets, characterized by 100% (or near full) ownership, represent the group’s primary levers for direct value creation through EBITDA expansion. By transitioning from a minority stakeholder to a major operator in these key businesses, Prosus is better positioned to drive the integration (into their ecosystems) and margin expansion central to their long-term growth strategy.

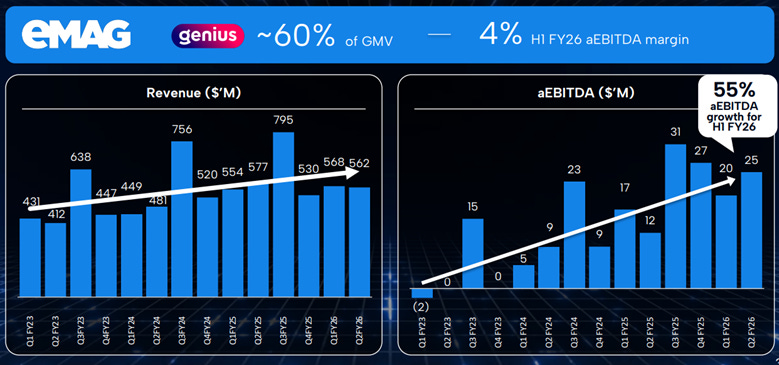

1. iFood

Current Valuation: $7.8 billion

iFood is a premier Brazilian online food ordering and delivery platform, and the core pillar of Prosus’s broader ecommerce strategy. Founded in 2011, the company has grown into a dominant leader in Brazil, now holding approximately 80% of the food delivery market in the country.

Prosus’s history with iFood reflects its long-term strategic thinking and capital commitment:

· Prosus first invested in iFood in 2013 through an affiliate company

· In August 2022 Prosus acquired the remaining stake from Just Eat Takeaway[32] for €1.8 billion, which converted iFood into a wholly owned subsidiary of Prosus (96% ownership)

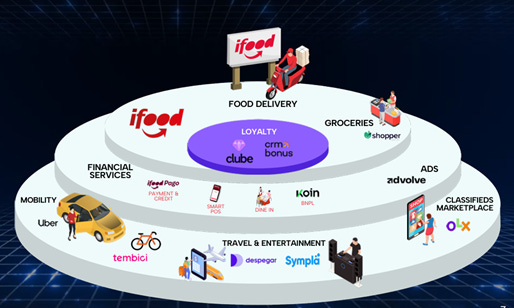

After withdrawing from all other Latin American markets in 2022[33], iFood has solidified its dominance in Brazil, reaching a milestone of 110 million orders per month by late 2025. It is showing signs of successfully transitioning into a super app that integrates multiple verticals (food delivery, grocery, financial services, payments, travel, online classifieds, etc.) and Prosus brands (iFood, iFood Pago, Despegar, OLX Brasil), creating a one stop digital hub for Brazilian consumers.

Integrating these elements into a “scale economies shared model”[34] is the iFood Clube (or “club”). This subscription-based loyalty program provides members with discounts across product offerings alongside free delivery benefits. To accelerate growth, iFood is diversifying its incentives through cashback points, voucher systems, and tiered discounts. Supporting this expansion, Prosus is planning to invest heavily, deploying $3.1 billion through March 2026 to scale its infrastructure and technology, and deepen user subsidies and rewards[35].

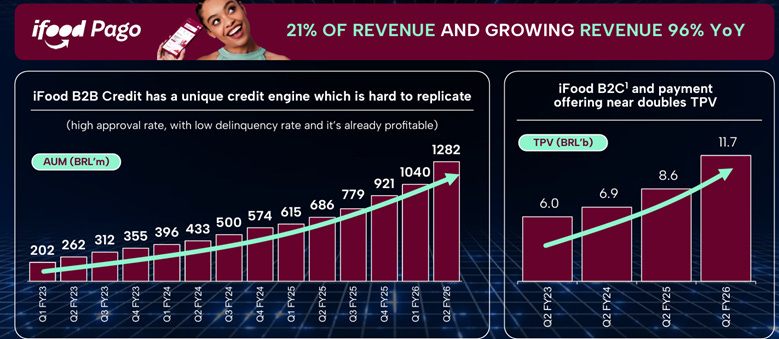

iFood continues to evolve its product offerings through a combination of new category launches and targeted bolt-on acquisitions. In 2025, the company significantly expanded its “dine-in” and B2B capabilities, acquiring Videosoft to integrate self-service totem[36] software and the AI marketing firm Advolve. Additionally, iFood acquired a 20% stake in CRMBonus to enhance its omnichannel restaurant technology, WhatsApp based ordering, and customer loyalty tools. iFood Pago, the fintech arm launched in Q1 FY 23, has been growing fast offers a range of financial services to restaurant partners in Brazil. Withing months of launching it was already processing $13.36 billion in annual transactions. Prosus is positioning iFood Pago to be a full-fledged financial services institution (also known as a “bank”) providing a full range of services to both merchants and consumers. This is a core component of Prosus’s strategy to expand iFood way beyond just food delivery and into a full-service convenience platform.

Having masterminded iFood’s success in Brazil, CEO Fabricio Bloisi[37] is now applying that same ecosystem blueprint across Prosus’s broader portfolio. His roadmap for 2026 focuses on transforming Prosus into a global tech operator by scaling high-engagement platforms in Europe and India. By leveraging iFood’s proven strategy of connecting diverse lifestyle services on a single platform, Bloisi intends to create world-class tech champions.

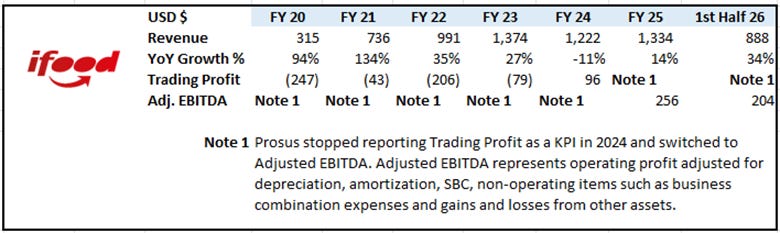

From a fundamental standpoint, iFood has demonstrated consistent top-line momentum with revenue growing at a steady 20% annual rate. The company has successfully pivoted from losses to robust profitability; in the first half of 2026, Prosus reported that iFood’s EBITDA of $204 million nearly matched the $256 million generated in all of 2025. Impressively, this was achieved on just $888 million in revenue compared to the previous year’s $1.33 billion, signaling powerful operating leverage[38] as the business scales.

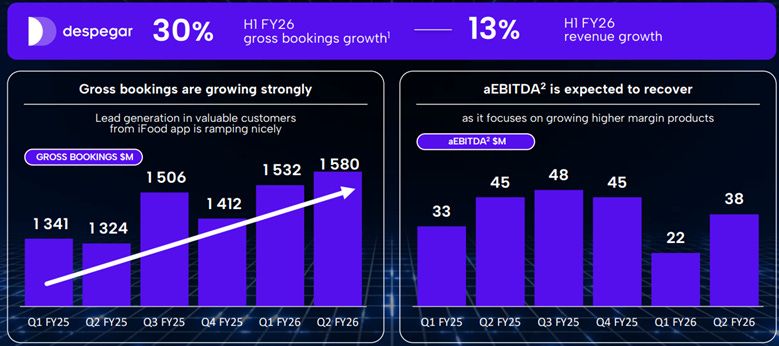

2. Despegar

Current Valuation: $1.8 Billion

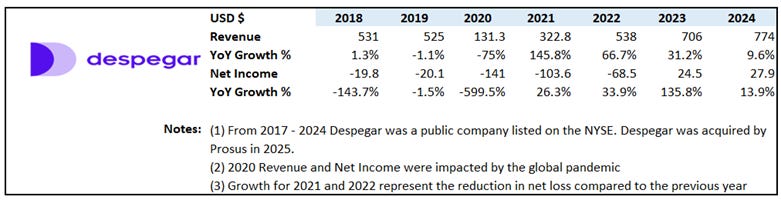

Despegar is a Latin American travel technology company that Prosus acquired in May of 2025 for $1.7 billion. Prior to the acquisition, the company had been publicly traded on the NYSE since its September 2017 IPO, providing some visibility into its financial performance as a standalone entity.

Despegar’s operations are divided into three main segments:

· Air Travel: Sale of airline tickets.

· Packages, Hotels, and Other Travel: Bundling and selling hotel accommodations, vacation rentals, car rentals, bus and cruise tickets, excursions, and travel insurance.

· Financial Services: Managed through its integrated fintech platform Koin, which provides consumer lending and various payment solutions to facilitate travel purchases.

Despegar maintains a broad geographic footprint across 20 Latin American countries. Beyond its direct-to-consumer website and mobile app, the company provides white-label B2B solutions, enabling banks and retailers to offer their own branded travel services. Its operational scale is further bolstered by key strategic alliances, including a major outsourcing agreement with Expedia Group and a deep inventory integration with HBX Group.

Moving forward, Despegar is focused on accelerating its B2C growth in Brazil while simultaneously consolidating its B2B operations. A central pillar of this strategy involves securing and scaling high-impact partnership opportunities with major corporate entities to extend its market reach.

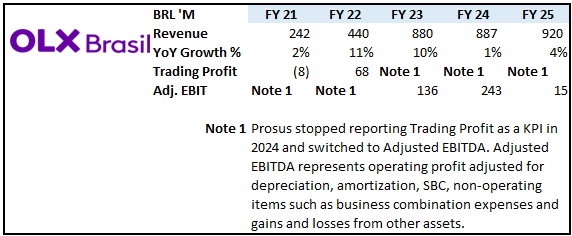

3. OLX Brasil

Current Valuation: $500 million

OLX Brasil (recently rebranded as Grupo OLX) is the leading horizontal online classifieds marketplace[39] in Brazil. Established in 2010, it operates as a 50/50 joint venture between Prosus and Adevinta (a European online classifieds company). The company has 53 million monthly active users and operates in 3 core business segments:

· General Classifieds: A platform for buying and selling almost anything, including, electronics, household goods, and fashion.

· Real Estate: Following the 2020 acquisition of Grupo ZAP, it became the dominant player in the Brazilian real estate market, and operates major portals like ZAP, VivaReal, and OlX Imoveis.

· Automotive (Autos): One of the largest vehicle marketplaces in the country, offering

While the broader OLX Group[40] reported record breaking profits, OLX Brasil struggled with a slight uptick in revenue but significant drop in profits due to shrinking margins. Prosus remains optimistic about the long term outlook for OLX Brasil, citing a strategic shift towards B2C core businesses (in automotive and real estate) and the integration of AI solutions to ease margin pressures. Prosus valued its OLX Brasil investment (separately from OLX Group) at $500 million.

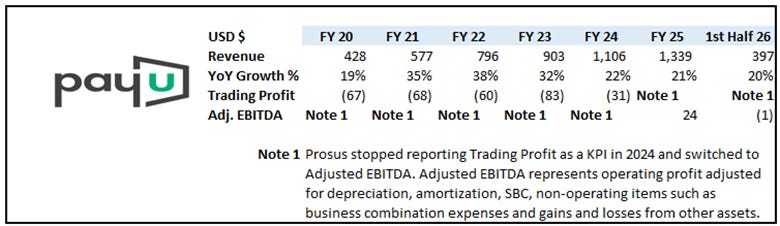

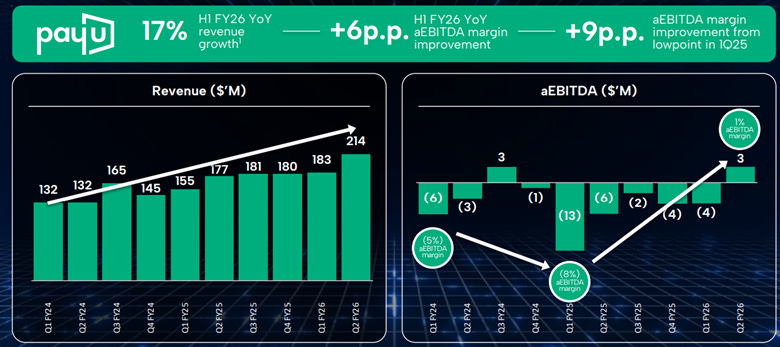

4. PayU

Current Valuation: $3.1 billion

PayU is a global fintech company and payment service provider (PSP) that enables merchants to accept and process payments. It operates as dual-layer platform serving as both a payment gateway and a payment processor[41].

PayU uses a “local to global[42]” approach, which has been especially successful in emerging markets by helping local businesses integrate hundreds of payment methods through a single API. PayU offers several products/services to merchants including:

Payment Processing: PayU uses a centralized platform to manage complex global payment stacks, optimizing approval rates and reducing transaction fees.

Local & Alternative Payments: PayU supports over 100+ different payment methods, including major credit/debit cards (Visa and Mastercard), digital wallets (Google Pay and Apple Pay), and local systems like UPI in India.

Security & Compliance: The platform is PCI-DSS certified and includes AI-driven anti-fraud systems and tokenization to secure transaction data.

· Consumer Credit: Beyond payments, PayU provides consumer credit solutions, such as Buy Now, Pay Later (BNPL), particularly in markets like India through brands like LazyPay.

PayU is consistently ranked as one of India’s top payment aggregators and leading fintech platforms, processing significant transaction volumes (10 million a day) and serving over 500,000 businesses. It is also a dominant player in other Southeast Asian, and Turkish markets, however it faces intense competition from companies like Razorpay and PhonePe.

Prosus views PayU as the central engine and critical connection point for its entire Indian ecosystem. PayU acts as the digital payment backbone for many Indian Prosus-backed companies like Swiggy, Meesho, and Rapido[43]. Beyond payments, PayU’s credit vertical (including LazyPay) is used to provide embedded financial services to Swiggy and Meesho merchants.

Prosus built its position in PayU through a decade-long “buy and build” strategy, consolidating multiple regional payment gateways into a single global brand, and owns 100% of the company. In a major strategic shift in March of 2025, PayU sold its GPO business, which covered most of Europe, Latin America, and Africa for $610 million. PayU is pivoting to focus exclusively on its high growth markets (India, Turkey, and Southeast Asia). In 2025 Prosus was exploring an IPO of PayU at a $5 - $7 billion valuation but this has been delayed for the time being.

The company has reported 20% year over year revenue growth for quite a number of years, but profits remained elusive. As of late 2025, PayU turned profitable and Prosus expects this positive trend to continue. Prosus has a current valuation on PayU of $3.1 billion.

5. Just Eat Takeaway (JET)

Current Valuation: $4.7 billion

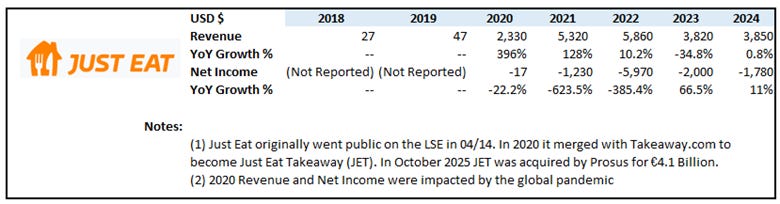

JET is a global online food delivery company focusing primarily on the European market and operating in about 17 countries across the continent. It is one of the newest acquisitions being acquired by Prosus in October 2025 for €4.1 billion. Just Eat originally went public in 2014 and merged with Takeaway.com to become JET. Because it is such a new acquisition no financial information of its performance is available, but we can look at its performance as a standalone company.

As you can see from the table above revenue and net losses have been extremely volatile with no discernible trend in the data. As a standalone company JET has never come close to turning a profit. This makes it a high stakes test for Prosus. If they can make JET profitable, it would validate their ecosystem model and prove that the competitive advantages realized at iFood are transferable across the portfolio. Failure to integrate and stabilize JET would suggest that Prosus is merely a collection of mediocre assets anchored by a single crown jewel, Tencent. Time will tell if this acquisition is a strategic masterstroke or structural burden.

Prosus has a valuation of JET at roughly its acquisition cost of $4.7 billion.

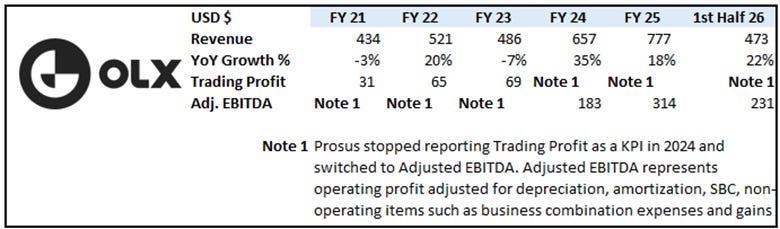

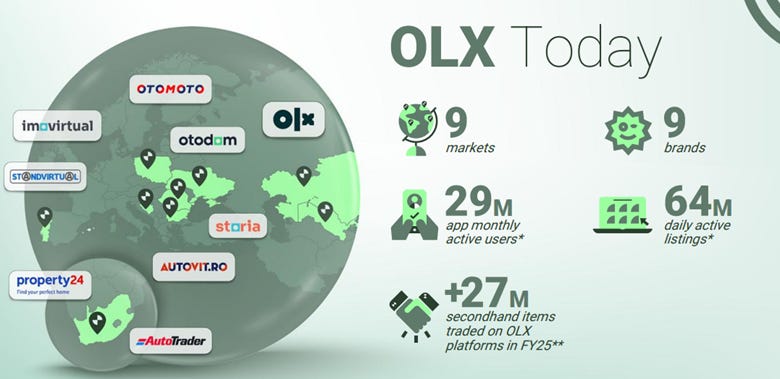

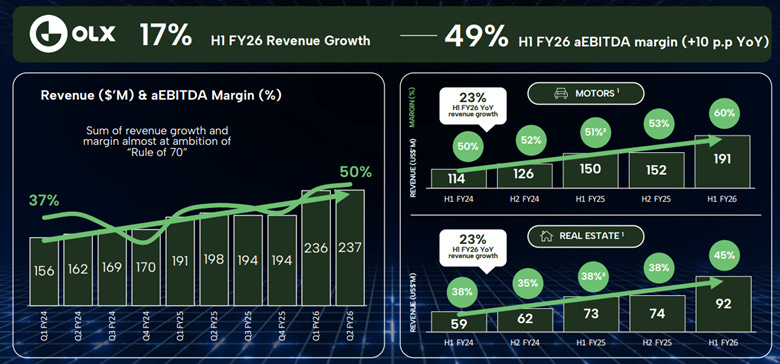

6. OLX

Current Valuation: $8 billion

OLX is a global leader in online classified ads and digital marketplaces. OLX provides regional platforms where millions of users buy, sell, and/or exchange goods and services locally. OLX operates on a consumer to consumer (C2C) and business to consumer (B2C) model and operates a digital marketplace (selling electronics, home goods, furniture, etc.) and higher margin specialized verticals (motors, real estate, careers – these 3 categories now represent 70% of total revenue).

Prosus’s initial investment in OLX was made in 2010 when it (Naspers) acquired a majority stake from the companies founders. In 2014 it acquired 100% of the company turning OLX into a wholly owned subsidiary. Prosus has continued to invest heavily in OLX, most recently acquiring vertical specific platforms like La Centrale (see La Centrale section below) for autos and Grupo ZAP (acquired in 2020 for $642 million) for real estate.

OLX utilizes a freemium model where basic listings are free. The company generates revenue from:

· Premium Listings (Approx. 60-65% of revenue) – Sellers pay to highlight their ads for better visibility. This is their dominant revenue source.

· Advertising (20-25%) – Selling ad space on its website and mobile apps to third-party advertisers. In some markets, advertising revenue have declined as the platform pivots towards more transaction based fees.

· Value Added Services (10-15%) – Other services and transactional tools such as secure payments, shipping solutions, vehicle history reports, etc. This is OLX’s fastest growing segment, increasing by 31% in the first half of FY 2026.

· Subscriptions (N/A) – Provides professional tools and analytics to car dealers and real estate agents for a recurring fee. OLX does not provide revenue information for this segment.

OLX has a global presence and is the dominant player in many markets including Poland, Romania, Bulgaria, Portugal, France, and South Africa. OLX has invested heavily in Artificial Intelligence to automate ad descriptions, improve fraud detection, and personalize user search experiences. Prosus has stated its intention to keep investing in OLX by focusing n expanding in its biggest highest growth categories (motors, real estate and careers).

OLX delivered strong financial results in the first half of 2026 with revenue of $473 million and EBITDA of $231 million, up 22% and 52% compared to first half of 2025, respectively. Margins also expanded 10 percentage points to 49%. This performance highlights OLX’s operating leverage and efficiency improvements.

Prosus valued its OLX subsidiary at $8.0 billion.

7. La Centrale

Current Valuation: $1.2 billion

La Centrale is a leading French classified platform for automobiles that was founded all the way back in 1969. Started as a print media business it now functions as an online digital marketplace. Because it was a private company we don’t have much information on the companies performance. It was acquired by Prosus subsidiary OLX in an all cash deal in September of 2025. Prosus values the company at its acquisition price of $1.2 billion.

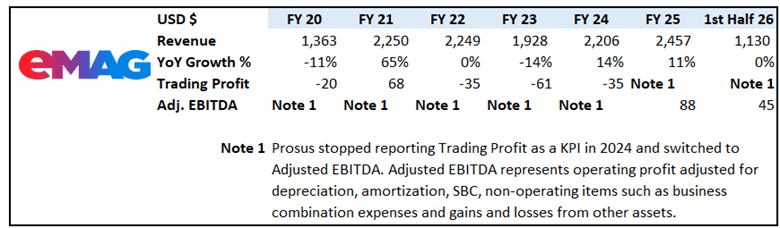

8. eMAG

Current Valuation: $2.1 billion

eMAG is the largest online marketplace and e-commerce leader in Romania (it is the most valuable Romanian company in the world), Bulgaria, and Hungary. It operates as both a first party seller (direct retailer) and operates a marketplace for over 53,000 third party sellers.

eMAG offers logistical support options, where for a fee sellers can have their inventory warehoused, picked, packed, and delivered to customers for them.

eMAG has its own logistics infrastructure including warehouses, and a nationwide network of lockers throughout Hungary and Romania. eMAG has invested heavily in its supply chain and currently owns the two largest warehouses in Central and Eastern Europe.

eMAG has a locker network throughout Hungary and Romania where customers can pick up and return orders whenever they want. This network continues to expand every year. With eMAG Genius, the customers Amazon Prime like subscription service, members receive free locker delivery as well as free returns within 60 days. eMAG genius now has around 1.1 million[44] paid subscribers.

eMAG has 15 showrooms in Romania and 3 in Bulgaria. These physical locations function as part of their omnichannel approach, allowing customers to test products, pick up online orders, and access services like applying for credit cards.

Through a partnership with PayU eMAG offers flexible payment services like installment plans or buy-now and pay later options.

Prosus acquired a 70% stake in eMAG in 2012 for around $82 million. Prosus acquired an additional 18% of the company in 2019. By then the valuation had risen to about $1 billion. Prosus’s current valuation of its eMAG stake is $2.1 billion.

Prosus cited “adverse macroeconomic environment in Romania” for recent challenges at eMAG.

It’s unclear what Prosus’s long term plans for eMAG are and how they fit into the broader European ecosystem. Do they intend to focus on gradual expansion within Eastern Europe or pursue more a ambitious, continent-wide buildout. eMAGs business is extremely competitive, capital intensive, and dominated by deep-pocketed multinationals that have their own expansion plans. Massive ongoing investment is a prerequisite to maintain ones market position. The primary strategic priority for Prosus will be to stabilize the company are return it to growth before determining its broader role in their regional e-commerce ecosystem.

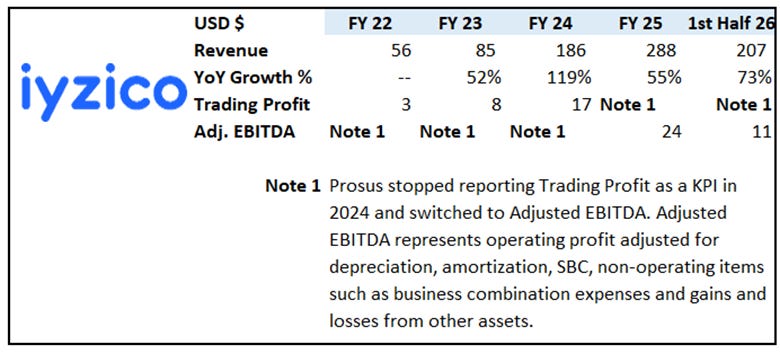

9. Iyzico

Current Valuation: $1.3 billion

Iyzico is a Turkish fintech that provides secure online payment solutions for e-commerce businesses, individual sellers, and consumers.

E-commerce services for businesses:

· Virtual POS: Enables businesses to accept credit and debit card payments.

· Marketplace Solutions: Automatically manages complex cash flows, such as splitting payments between sub-sellers, calculating commissions, and other services.

· Link Method: Secure payment links that can be shared on social media or messaging aps to allow sellers to receive payments without a website.

· AI-Based Fraud Protection: Uses an in-house system called Frauctive to analyze transactions in milliseconds and prevent fraudulent activity.

· Smart Payment Routing: Automatically redirects potentially failed transactions to different bank POS systems to ensure the sale goes through.

Services for consumers:

· Pay with Iyzico: A digital wallet that allows users to pay via stored cards, their iyzico balance, or protected bank transfers.

· Iyzico Card: A prepaid card that users can top up and use for both online and physical store purchases without needing a traditional bank account.

· Protected Shopping: Provides 24/7 live support and simplified refund/cancellation processes for purchases made through its network.

· Shopping Credit: Offers users the ability to pay for purchases in installments of up to 36 months through contracted banks.

Prosus acquired Iyzico in 2019 for $165 million. Since the acquisition Iyzico has continued expanding into new products and services, completing its own $87 million acquisition of the payment provider Paynet in February 2025.

Iyzico is widely considered to be the leading payment gateway in Turkey, often cited as a market leader in e-payment processing for merchants. Prosus’s plan appears to use its other subsidiary companies as platforms for Iyzico to penetrate other markets across Europe.

Public/Pre-IPO Equity Investments

Prosus maintains a portfolio equity investment in companies that are publicly traded, or nearing an IPO. Many of these companies have been backed by Prosus since their early days as small startups and part of the company’s broader regional strategy. For example, many of the Indian companies (Swiggy, Meesho, Urban Company, etc.) use PayU for their payment and fintech needs on their platforms.

1. Swiggy

Traded As: NSE: SWIGGY, Market Cap: $9 billion

Prosus Stake: 25%, $2 billion

What it does: An Indian online food ordering and delivery company.

How Prosus Acquired its Stake: Prosus acquired its stake in Swiggy through a series of early stage venture investments acquired over seven years and becoming Swiggy’s largest shareholder investing approximately $1.3 billion and at its peak holding a 38% position in the company. During and subsequent to Swiggy’s IPO in November 2024, Prosus reduced its stake to 25% realizing a $2 billion profit on the sale of the shares.

Financial Performance (fundamentals): Since its IPO Swiggy has been growing revenues quickly with a 5 year CAGR of 56%. Swiggy is currently engaged in a battle for market share with two competitors Zomato and Zepto, which has put pressure on their margins. The company is not close to profitability and in Q3 2025 their net loss widened by 33% to $116 million.

2. Meesho

Traded As: NSE: MEESHO, Market Cap: $8.8 billion

Prosus Stake: 11.2%, $1 billion

What it does: An Indian ecommerce platform founded in 2015.

How Prosus Acquired its Stake: Prosus invested approximately $162 million between 2019-2021 through a series of funding rounds establishing a 14% stake.

Financial Performance (fundamentals): While Meesho has never turned a profit, operating revenue grew 29% and the net loss was down 72% in the first half of its FY 2026 (04/25 – 09/25). The company still likely has a year or two of losses before it achieves breakeven or becomes EBITDA profitable.

3. Delivery Hero

Traded As: FWB: DHER, Market Cap: $9 billion

Prosus Stake: 27% stake, $2.5 billion

What it does: A German multinational food ordering and delivery company. Founded in 2011 and currently operating in over 60 countries globally.

How Prosus Acquired its Stake: Prosus established its position in Delivery Hero through a series of multibillion dollar investments, market trades, and corporate restructurings between 2017 and 2021.

Other: As part of the JET acquisition EU regulators concluded that Prosus’s ownership of two major food delivery companies operating in the region was anticompetitive. Prosus has relinquished its board seat, voting rights, and pledged to fully divest its Delivery Hero[45] position within 12 months (around August 2026).

4. Meituan

Traded As: SEHK: 3690, Market Cap: $76 billion

Prosus Stake: 5%, $2.7 billion

What it does: A Chinese technology company that operates as a platform for services including, food delivery, ecommerce, hotel and travel bookings, and in-store retail services.

How Prosus Acquired its Stake: Meituan was a portfolio investment of Tencent that it distributed to its investors as a dividend in kind distribution in 2023. As Tencent’s largest shareholder Prosus received a significant portion of these shares and Prosus’s stake was valued at approximately $3.7 billion to $4 billion at the time of receipt. Prosus has been slowly selling its stake.

Other: In October of 2025 Meituan entered the Brazilian market and is directly competing with iFood and other Prosus subsidiaries. Prosus has significantly reduced it’s stake in the company and are likely to fully exit this position in the near future[46].

5. Remitly

Traded As: NASDAQ: RELY, Market Cap: $3 billion

Prosus Stake: 12.3%, $400 Million

What it does: An American online remittance company that offers international money transfers to over 170 countries

How Prosus Acquired its Stake: Prosus acquired it’s stake in Remitly through its fintech subsidiary PayU which led and participated in multiple private funding rounds prior to Remitly’s IPO in September of 2021, including;

· PayU led a $115 million Series D round in 2017

· PayU participated in a $220 million funding round in 2019

· PayU led an $85 million funding round in July 2020

Before its IPO Prosus was Remitly’s largest shareholder with a 23.9% stake.

Performance (fundamentals): Since it’s IPO Remitly has had strong 25%+ year over year revenue growth. Remitly had its first small profit in Q3 2024 and has been consistently profitable since Q1 2025. The stock has lost roughly two thirds of its value from its IPO price, due primarily to concerns over potential impacts to their underlying business due to stricter US immigration policies.

6. Ixigo

Traded As: NSE: IXIGO, Market Cap: $1.09 billion

Prosus Stake: 15%, $200 million

What it does: An Indian online travel portal, Ixigo aggregates real-time travel information and facilitates booking for flights, trains, busses, and hotels.

How Prosus Acquired its Stake: In late 2025 Prosus built a stake in Ixigo acquiring 10.1% via a preferential share issue and 5% from existing investors, bringing its total stake to around 15%.

Performance (fundamentals): Ixigo has been growing fast and is profitable, which is impressive for a company that went public in June 2024. It’s 5 year revenue CAGR is over 60% while its net income CAGR is almost 70%. As of Q3 FY26 (December 2025) revenue rose 31.4% to $34.58 million and net income surged 56.1% to $2.63 million. Small numbers in absolute terms, but if they can maintain the growth rates, they can scale into a potentially large and profitable company.

7. IonQ

Traded As: NYSE: IONQ, Market Cap: $16.12 billion

Prosus Stake: 1.2 million shares, 0.35%, $100 million

What it does: An American quantum computing[47] hardware and software company. The company develops general purpose trapped ion quantum computers and the accompanying software to generate, optimize, and execute quantum circuits.

How Prosus Acquired its Stake: Prosus Ventures was an investor in Oxford Ionics, a UK based quantum computing startup that IonQ acquired for $1.1 billion in 2025.

Performance (fundamentals): While revenue more than quadrupled between 2022 and 2024 from $11 million to $44 million, the net loss during the same period has almost 10x’d from -$48 million to -$332 million. These numbers are not promising. With just over a billion dollars in cash and negative free cash flow of over $127 million in Q3 2025 alone, IonQ does not have a tremendously long runway in making itself a viable, profitable business.

8. Urban Company

Traded As: NSE: URBANCO, Market Cap: $1.9 billion

Prosus Stake: 7.35%, $100 million

What it does: An Indian app that connects individuals with professionals for various home services like cleaning, repairs & maintenance, beauty & wellness, and pest control.

How Prosus Acquired its Stake: Prosus acquired its stake in Urban Company through a series of funding rounds and secondary market transactions between 2021 and 2025. By the time of its IPO Prosus was one of its largest shareholders with a 7.35% stake.

Performance (fundamentals): Revenues are growing fast but the company is not yet profitable on a consolidated basis.

9. SimilarWeb

Traded As: NYSE: SMWB, Market Cap: $488.35 million

Prosus Stake: 13.5%, $66 million

What it does: A global software development company specializing in mobile app, web analytics, digital performance, and SEO tools.

How Prosus Acquired its Stake: Prosus began backing the company in its early venture stages, investing $40-$55 million in various funding rounds in 2014 and 2015. By the time of its IPO in 2021 Prosus held an approximately 16.7% stake in the company valued at $267 million.

Performance (fundamentals): Since going public in 2021 revenue has grown steadily while net losses have narrowed. In 2024 revenue was $250 million and the net loss was -$12 million compared to revenue of $218 million and a net loss of -$29 million in 2023.

10. Skillsoft

Traded As: NASDAQ: SKIL, Market Cap: $78.83 million

Prosus Stake: 36%, $30 million

What it does: An American educational technology (Ed Tech) company that produces learning management system software and content.

How Prosus Acquired its Stake: In October 2020 Prosus initially invested $100 million in the company as part of a SPAC merger and November 2020 it exercised an option to invest an additional $400 million, building a 38.4% stake in the newly public Skillsoft.

Other: This investment was part of a broader strategy to build a global EdTech ecosystem. These investments were largely unsuccessful, Prosus has abandoned its EdTech ecosystem strategy, and recognized significant impairment charges on its Skillsoft investment.

Performance (fundamentals): Skillsoft has faced consistent challenges in growing revenue while remaining largely unprofitable. Annual revenue peaked near $555 million in 2023 but has since declined to $531 million in 2025. The company has struggled with deep net losses, including a $725 million loss in 2023 and a $122 million loss in 2025.

11. Bluestone

Traded As: N/A - In the process of launching its IPO

Prosus Stake: 4.43%, $30 million

What it Does: An Indian omnichannel jewelry retailer

How Prosus Acquired its Stake: Prosus invested $42.2 million dollars and holds a 4.43% stake in the company

Performance (fundamentals): Unknown

12. Stack Overflow

Traded as: N/A

Prosus Stake: 100% owned by Prosus, $600 million valuation (after $1.2 million of write-downs due to impairment)

What it Does: Launched in 2008, Stack Overflow acts as a message board (think Reddit) for computer programmers. Stack Overflow makes money through advertising, job listings, subscription services to enterprises (SaaS), and data licensing.

How Prosus Acquired its Stake: In 2021 Prosus acquired 100% of Stack Overflow for $1.8 billion.

Other: Stack Overflow’s monthly active users and overall traffic peaked around 2014-2017 and have been in general decline since. A trend that has accelerated with the rise of AI tools in 2022. Despite this the company’s revenue hit an all-time high of $115 million in 2025. This was not a successful investment by Prosus. It’s unclear what the future of Stack Overflow and the rest of the EdTech portfolio will be.

Venture Capital Portfolio

In 2025 Prosus invested $400 million in more than 40 closed transactions of which $88 million were AI related investments. This adds to their portfolio of hundreds of companies that are at various stages of their lifecycle journey from early stage ventures, to companies that are nearing or launching IPO’s. Prosus values its portfolio of these companies at $5.6 billion.

Consolidated Financials and Capital Allocation

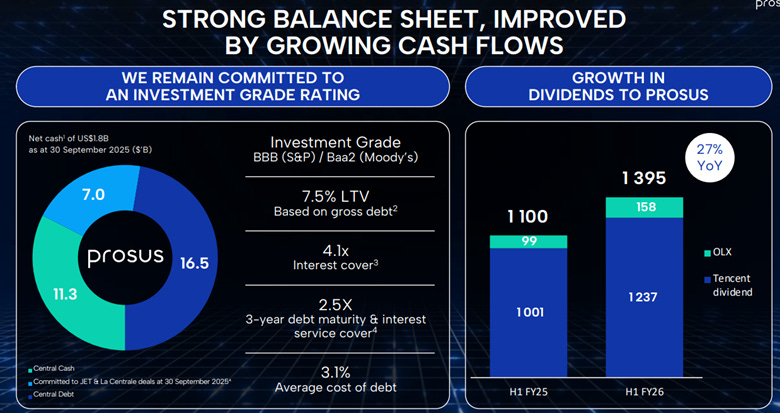

1. Balance Sheet

Prosus maintains a “fortress balance sheet” and ended 2025 with around $17 billion of net cash after accounting for roughly $7 billion of committed deal funding[48] and a recently received $1.2 billion dividend from Tencent. In addition, the group maintains a $2.5 billion unused revolving credit facility. An additional $5.2 billion[49] of liquidity could come from the Meituan and Delivery Hero divestments which may occur in 2026. Such financial firepower will allow Prosus to comfortably pursue selective acquisitions, fund ecosystem build-outs, and support its portfolio companies through the business cycle while maintaining a strong investment grade profile.

Total Assets of $79.6 billion provide nearly 3.3x coverage of total liabilities ($24.2 billion). A current ratio of 3.66 signals very strong liquidity and significant ease in meeting short term financing obligations. The 31.9% debt to equity ratio shows the company is conservatively financed for the long term.

2. Income Statement / Cash Flows

Due to all the moving pieces, it’s challenging to evaluate Prosus’s income statement on a consolidated basis. The results of Tencent tend to drown everything else out which look immaterial in comparison. For example iFood’s 2025 adjusted EBITDA represented 3.1% of Prosus’s share of Tencent’s 2025 EBITDA. Some highlights for FY 2025 and 1H FY2026 are detailed below.

FY 2025 Highlights:

· Net income for FY 2025 was $12.37 billion, an 87% increase from 2024

· The ecommerce portfolio (ex. Tencent) recorded $443 million aEBIT, more than double the prior year

1H FY 2026 Highlights:

· Consolidated revenue increased 22% to $3.6 billion

· EBITDA growth of 70% YoY to $530 million

Finally, Prosus had its first ever period of positive free cash flow (ex. Tencent) in H1 FY26. It’s small[50], but a start.

3. Capital Allocation

At the end of 2025 Prosus announced and paid a 100% increase in its dividend, raising the payment to €0.20 per share. The increased dividend reflects the strengthened balance sheet, profitability of the ecommerce portfolio, and the company becoming free cash flow positive. Dividend payouts could increase significantly as operating cash flows scale over the next few years.

Prosus has been cannibalistic when it comes to share buybacks, having repurchased 30% of its outstanding shares in the last 5 years. This is significantly more than any other peer technology company. Share buybacks are a somewhat nuanced topic, but in our view when shares are purchased by a company at or below their intrinsic value[51] they are value-accretive to shareholders. Prosus is increasingly funding its $6-$7 billion annual share buyback program through non-Tencent asset sales and ecommerce profits rather than new debt issuances. This trend should continue.

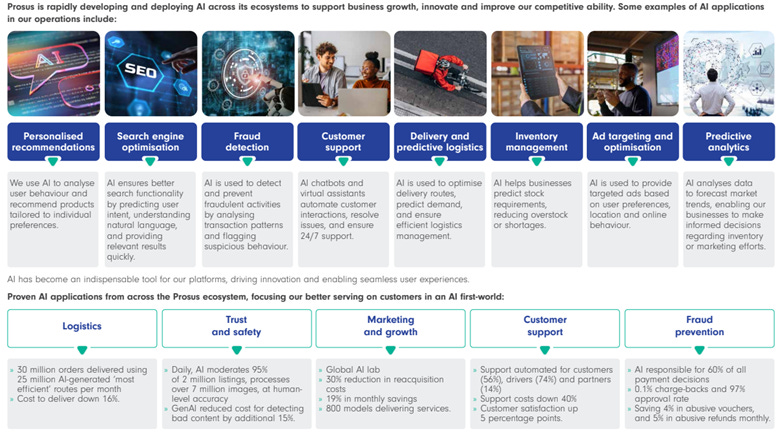

Artificial Intelligence

Artificial intelligence is a complex topic and it is extremely difficult to parse the hype from reality, which is why it hasn’t been highlighted in detail for Prosus until this point. Prosus claims to be an “AI first” company which means that they are not just an AI investor, they develop AI tools in house and deploy them across their portfolio. Their AI strategy includes:

· Specialized Talent & Investment: Prosus has assembled a dedicated team of over 1,000 AI specialists. It invests over $100 million annually in talent, infrastructure, and model development/maintenance.

· Agentic AI: The company has tens of thousands of agentic AI models in active production. For example, iFood has over 800 agents deployed for various repetitive tasks like order routing and push notifications. Prosus is heavily investing in the “application layer[52]” backing startups like Lastro ($15 million Series A) and Clarity ($12 million) that focus on specialized AI agents.

· Large Commerce Model (LCM): In late 2025, Prosus launched a specialized Large Commerce Model (LCM) designed to leverage the data from its 2 billion customers, predict their behavior/purchasing patterns, and deliver them more targeted results than standard search functions.

· Frontier Technologies: Beyond standard software, Prosus Ventures targets opportunities in the digital AI workforce, robotics, and synthetic biology sectors.

· EdTech: Through Stack Overflow Prosus is building OverflowAI a suite of generative AI tools designed to assist developers with coding. It leverages Stack Overflows database of human-verified, peer-reviewed technical questions and answers, prioritizing accuracy trust. This is similar to Reddit’s sale of its data for AI training which has been very successful for the company.

Prosus’s strategy hinges on owning the application layer of AI using its proprietary data and vast reach to solve real world problems through virtual assistants and intelligent services. Prosus does not have a “full stack” vertically integrated AI program, is limiting there investment to the application layers and are not investing in data centers like hyperscalers (Amazon, Alphabet, Meta, etc.) so they are not directly exposed to those risks (though Tencent is). Ultimately Prosus sees AI as the engine that could turbocharge its ecommerce flywheel, using proprietary data to enhance user engagement, reduce costs, and increase profitability. While this is true, the threats to Prosus from disruption, erosion of their competitive moats, and potential malinvestment by the company, make AI a double-edged sword. We cannot conclude and offer no opinion on whether Prosus will ultimately be an AI winner or loser. Time will tell.

Risk Factors

General Risk Factors

· Tencent and US – China Relations: Prosus holds its Tencent stake directly in Hong Kong exchange shares not the Tencent ADR. However, it is still exposed to significant risks from a potential broader US delisting of Chinese technology companies. US officials have made statements that all options, including the removal of Chinese companies from US exchanges were being considered amidst the trade tensions in 2025. In April of 2025, Goldman Sachs estimated that a “delisting risk” of 66% was embedded in Chinese ADR’s with an extreme scenario impact of $800 billion USD[53]. While tensions seemed to have eased for the time being, this will remain an area of focus and concern for the remainder of the Trump administrations term in office.

· China Geopolitics: China is becoming a more assertive and powerful military power, especially in Southeast Asia. Heightened maritime incidents and border disputes have raised tensions in the region. Were China to go to war with one of its neighbors or attack Taiwan, that would be disastrous for the world in general and Prosus specifically. As a result of Russia invading Ukraine Prosus was forced to write off or sell several Russian assets, recognizing $4 billion of losses in the process. The Russian losses would be a tiny appetizer in relation to the massive losses Prosus would take on Tencent should an adverse scenario occur.

· China Regulatory: While seemingly in a period of détente, the Chinese governments relationship with its tech sector remains fractious and complicated. The intense 2020-2022 regulatory crackdown has eased, and the Chinese government is now relying on its technology sector for economic growth. This could change rapidly and foreign investors remain cautious, impacting current and future valuations.

· Emerging Market Risks – Latin America: New US trade policies and tariff decisions have introduced significant uncertainty in the region, affecting everything from currencies, imports/exports, GDP, inflation, and employment. If Latin America enters a prolonged period of low growth, that could have knock on effects for Prosus’s Latin American ecosystem, leading to lower volumes, shrinking margins, and lower EBITDA.

· Emerging Market Risks – India: India is projected to be the world’s fastest growing major economy in 2026 with GDP expected to reach a blistering 7.4%. Inflation is also expected to be low at 1.7%. Despite all this India still saw record outflows of foreign investment from its capital markets. Investors sold a record $18-19 billion in Indian equities during 2025. In January 2026 alone, outflows exceeded $3.5 billion. This does not bode well for the short-term prospects of Prosus’s publicly listed Indian investments. High dependence on imports and US trade tariff policy (as high as 50% on certain Indian goods) will remain a primary trigger for uncertainty and market volatility.

· Europe: As an Amsterdam-headquartered firm with global assets, Prosus remains highly vulnerable to Euro fluctuations and capital outflows from emerging markets, which can depress the Net Asset Value (NAV) of its non-European holdings. In January 2026, CEO Fabricio Bloisi branded EU Antitrust demands as “absurd” after regulators required Prosus to divest its Delivery Hero stake as a condition for the JET acquisition. Shifts in U.S. trade and protectionist policies could drive major European tech and industrial players to shift operations to the U.S., potentially draining the talent pool and investment capital Prosus relies on for its European “ecosystem”. Prosus will likely be negatively impacted by compliance with the EU AI Act, scheduled to go into effect in August 2026. Prosus predicts at least three of its major AI systems may become unavailable in Europe due to their “high-risk” classification.

· Narrow Moats (Barriers to Entry): Prosus faces competitive challenges as many of its businesses posses only narrow moats, with some relying on network effects and efficient scale while other lack structural protections entirely. This leaves the portfolio vulnerable to constant disruption from global tech giants eager to expand, epitomizing Jeff Bezos’s mantra that one company’s margin is another’s opportunity. A clear illustration of this threat is Meituan’s expansion into Brazil to challenge iFood, proving that while Prosus can disrupt others, it is equally susceptible to aggressive competition. Consequently, maintaining market share relies almost exclusively on flawless operational excellence, as there are few defensive moats to prevent rivals from encroaching on their territory.

· Execution Risk: Prosus operates within highly dynamic and intensely competitive industries where long-term success hinges on flawless strategic execution with little margin for error. This high stakes environment demands that the company consistently identify and consummate key acquisitions at fair valuations. The ongoing challenge of seamlessly integrating these entities into their broader ecosystem remains a persistent challenge. Any inability to identify and adapt to changes in the business environments in which they operate could undermine the companies market position and future growth prospects.

· Disruptive Threats from AI: On January 30, 2026 Google debuted Project Genie, a powerful prototype generative AI application that can generate interactive, 3D virtual environments in real time using only text or image prompts. The AI is able to simulate complex physics and interactions, allowing users to navigate and interact with the world as it generates the environment in real time. The tool can even generate simple, side scrolling games where users can control a character using their keyboard. This announcement was viewed as a major broadside attack on the video game industry for a number of reasons:

o For over a decade games have relied on complex engines to render the lighting, physics, and gravity for their environments. Tencent’s Unreal Engine is one of the industry standards accounting for 28-31% of all games sold in 2024. Project Genie has lead to fears that dedicated game engines may become obsolete.

o Premium titles typically take five to seven years and hundreds of millions of dollars to build. AI could potentially collapse these timelines and budgets, and the structural competitive advantages that come with them.

o Early tests showed the model could realistically recreate “knockoffs” of copyrighted games like Super Mario or Zelda from simple prompts, raising major legal and intellectual property concerns. While IP owners can assert and maintain their rights, litigation could cost tens of millions of dollars or more.

o As a result of the announcement Prosus (PROSY) stock dropped 5% and Tencent (TCEHY) dropped 4% for the day. While we believe this event represents more uncertainty for game developers than actual risk, the potential future risks from disruptive events to (all of) Prosus’s and Tencent’s businesses caused by AI is deemed to be High and cannot be ignored.

Conclusion

If you read this far, or even read a brief portion of this paper, thank you! You won’t find any revenue, and EBITDA estimates projected out 20 years and then discounted back to the present value. The core investment thesis for Prosus is extremely straightforward:

· Prosus is no longer merely a holding company for Tencent shares. It is a strategically assembled portfolio of three cohesive, high-quality ecosystems that will generate superior earnings and could develop sustainable competitive advantages.

· The market currently undervalues Prosus, treating it as a low-quality entity with an anemic 10x multiple. A re-rating to a more appropriate technology multiple is anticipated as the market recognizes the inherent high quality of its diverse assets.

· Even if a multiple re-rating is slow to materialize, expected significant increases in EPS[54] should independently drive the stock price higher.

· Aggressive share buybacks, executed at prices significantly below intrinsic value, continue to serve as a powerful catalyst.

Prosus is a puzzle of moving parts and layers of complexity. Having completed the research for this report it’s easy to see why investors are confused and don’t understand the company. This is not the simple business Warren Buffett loves. This isn’t a company an idiot could run. It requires a skilled and competent manager. Luckily, Fabricio Bloisi seems to have exactly the skillset needed to pull this off.

Investing in Prosus carries a significant and straightforward risk rooted in the problem of induction[55], where no duration of steady earnings growth or upward price movement can ever truly validate it as a “safe” or “stable” investment. Because the company’s value is inextricably linked to volatile geopolitical dynamics, a single overnight shift in Chinese domestic policy or military action could instantly trigger a catastrophic drawdown of 50-60% or more, rendering historical performance data irrelevant. Consequently, while we believe maintaining some exposure to Prosus is beneficial, we would advise against building a concentrated position, and to employ rigorous risk management[56] by taking profits should there be periods of significant price appreciation in the stock. Ultimately an allocation to Prosus must be carefully weighed against one’s broader portfolio strategy and asset allocation, to ensure that a sudden and unpredictable “Black Swan” type event[57] does not jeopardize one’s portfolio or investment goals.

Questions/Comments/Feedback?

We’d love to hear it and are always looking to connect with likeminded investors. Contact us at: LotsOfValue05@gmail.com

Disclaimer

Disclaimer: The information provided on Lots of Value is for general informational and educational purposes only. It is not intended to be, and should not be construed as, professional financial, investment, tax, or legal advice. Lots of Value is not a registered investment advisor or fiduciary.

The author(s) or owner(s) of this blog may currently hold positions, or plan to initiate positions, in the securities, ETFs, or other financial instruments discussed in these posts. We disclose this to maintain full transparency with our readers. However, our ownership status may change at any time without notice, and we are under no obligation to update this blog to reflect when a position has been sold or adjusted. You should not assume that our interests are aligned with yours; always perform your own due diligence before making any investment.

Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Any decision to invest should be made only after consulting with a qualified professional and performing your own due diligence. Lots of Value makes no representations as to the accuracy, completeness, or suitability of the information provided and will not be liable for any losses, injuries, or damages from the display or use of this information.

Dedication

“What are the secrets of success? – One word answer: Rational” – Charlie Munger

Dedicated to the memory of Richard Abramson and Charlie Munger. Exemplars of rationality who taught us that the most profound lessons are lived, not just spoken.

To Katya, Byron, and Pushkin with love.

About the Author

Evan Lotzof is a professional with over 20 years’ experience in financial services. He spent ten years in “Big Four” public accounting and consulting. The last ten years of his career have been in Internal Audit with a focus on payments. Evan holds Certified Public Accountant (CPA), Certified Internal Auditor (CIA), Certified Fraud Examiner (CFE), Certified Financial Services Auditor (CFSA), Certification in Risk Management Assurance (CRMA), Certification in Control Self Assessments (CCSA), and Certified Anti-Money Laundering Specialist (CAMS) certifications.

Special Thanks

Special thanks to Jeff Holman, PhD, for his thoughtful feedback which was instrumental in refining this report.

[1] Growth at Any Cost - A business strategy that prioritizes rapid customer acquisition, market share, and revenue growth over profitability

[2] “We insist on a margin of safety in our purchase price. If we calculate the value of a common stock

to be only slightly higher than its price, we’re not interested in buying. We believe this margin-of-safety principle, so strongly emphasized by Ben Graham, to be the cornerstone of investment success.” 1992 Berkshire Hathaway Letter to Shareholders (https://www.berkshirehathaway.com/letters/1992.html)

[3] While we use EBITDA throughout this report, we do so with caution. We share Charlie Munger’s skepticism of the metric. He famously suggested substituting it with the term “bullshit earnings”. But since it is the only entity level metric Prosus provides, we have adopted it out of necessity.

[4] One way to think about investing in Prosus: When you buy a share of Prosus, you are getting Tencent at a discount and getting all the other assets for free.

[5] Estimated to be between 14-30% as of January 2026. We have not performed this NAV calculation ourselves (unlike with Prosus itself) and are relying on the work of other analysts for this. Tencent’s financial structure is somewhat opaque and Chinese financial statements are difficult to interpret and understand.

[6] We prefer net income but can’t get this information on an entity level basis

[7] See the “cross holding structure” in the General Company Background section

[8] “The obvious point involves basic arithmetic: major repurchases at prices well below per-share intrinsic business value immediately increase, in a highly significant way, that value. When companies repurchase their own stock they often find it easy to get $2 of present value for $1.” 1984 Berkshire Hathaway Letter to Shareholders (https://www.berkshirehathaway.com/letters/1984.html)

[9] This is not theoretical and Prosus has hit several multibagger homeruns in its venture portfolio. See Swiggy, Meesho, and others in the “Public/Pre-IPO Equity Investments” section for additional details.

[10]“I never allow myself to have an opinion on anything that I don’t know the other side’s argument better than they do” Charlie Munger. This section was prepared with some AI prompt engineering help from the “AI Equity Analyst”. You can download a free copy here: https://mcusercontent.com/57cdfc490b101d54b70128c06/files/b4d2eab2-a3a8-fb64-9266-317b71198656/AIEquityAnalyst.01.pdf

[11] 2024 financial information

[12] All data presented in this paragraph is ex. Tencent

[13] See Just Eat, Despegar, and La Centrale in the “Wholly Owned Subsidiaries” section

[14] https://www.prosus.com/~/media/Files/P/Prosus-CORP/AGM%20FY2024/2%20Prosus%20Disclosure%20of%20Chief%20Executive%202024.pdf

[15] A super app is a mobile platform that offers a diverse suite of services like messaging, payments, ecommerce and food delivery, all bundled together in a single integrated application to provide a “one stop shop” user experience.

[16] Organic growth in their existing companies, as well as growth through bolt-on & tuck-in acquisitions of complimentary companies to enhance the capabilities of their existing companies, whole company acquisitions like Just Eat and Despegar, and strategic equity and venture investments in standalone companies.

[17] The “scale economies shared” framework is the primary engine behind the ecosystems compounding value. By prioritizing volume over immediate margin capture, Prosus backed platforms reinvest operational efficiencies directly into lowering consumer pricing. This creates a powerful flywheel effect, where expanding scale lowers unit costs, and cost savings are passed to customers, accelerating market share gains and defensive moats. Amazon Prime is a good example of a scale economies shared model being successfully implemented. See the iFood section for additional details on how they are investing $3.1 billion credits/discounts for customers.

[18] When Elon Musk spoke of transforming Twitter into a super app his archetype was WeChat. WeChat has embedded applications, known as Mini Programs that run entirely within the WeChat platform. They function like standard mobile apps but require no separate download or installation. In the past Tencent has taken equity stakes in many of its Mini Program developers. In 2026 they are shifting away from this strategy offering operational support and technical incentives, to focus its equity capital investments on the highest value highest growth sectors like gaming and AI foundational model startups.

[19] A unicorn is a company with a private or public valuation of $1billion or more. The 160 unicorn total is as of January 2020. We were unable to find updated statistics.