Prosus Update 02/07/26

Recent Market Events and the CEO's Letter to Shareholders

We didn’t expect to provide an update to our analysis of Prosus so soon (you can read the initial report here: https://lotsofvalue.substack.com/p/prosus-prosy-company-analysis-as) but there have been quite a number of significant recent events:

· Tencent (TCEHY) stock is down approximately 12% year to date. There were three major developments affecting Tencent:

o The Hang Seng Tech Index fell in early 02/26 entering bear market territory[1]

o Beijing significantly raised taxes on companies in its telecom sector and other select industries in an effort to boost government revenues in the face of a persistent economic slowdown. There are fears that these tax increases could be extended to other sectors like internet and video gaming companies. Chinese tech stocks like Alibaba and Tencent have been heavily impacted as a result.

o Tencent’s AI chatbot Yunbao launched a major “red packet” promotion that planned to give out $144 million in cash through WeChat to users, but WeChat didn’t allow it saying the promotion “induces users to share links to WeChat groups in high frequency, disrupting the platforms ecosystem, impacting user experience…”. This is very odd since WeChat is also owned by Tencent. Yunbao found a workaround to make the promotion shareable in WeChat but it is more difficult for users. In the past Tencent has been protective of its ecosystem and blocked links from other companies like Alibaba and ByteDance, but this is the first time they have blocked a sister company, and it leads us to question the coordinated cohesiveness of their overall AI strategy.

· Prosus (PROSY) stock is down approximately 14% year to date – There is nothing to really point to here to explain the drop other than the drop in Tencent stock[2], and the volatility in global markets, especially the technology sector.

We are not sure if it was because of these recent events, or just a coincidence, but Prosus’s CEO Fabricio Bloisi, released a letter to shareholders on 02/05/26 titled “Entering 2026 Focused on Execution”. It’s only a few pages, and you can read it here: https://www.prosus.com/~/media/Files/P/prosus-corp-v2/investors/fabricio-new-year-letter-to-shareholders.pdf

Here’s a summary of what he said in the letter:

· He acknowledged the increased global uncertainty and the challenging, higher risk environment. The changing dynamics don’t alter Prosus’s strategy which remains to focus on “growth, profitability, and constant innovation” in its core geographies of India, Europe, and Latin America.

· In 2026, Prosus is completely focused on execution. While they made several major acquisitions in 2025[3], they have no plans for “major M&A[4] at the moment”. Instead, they plan on selling more than $2 billion in assets[5] , with plans to sell even more non-strategic and underperforming assets in 2027.

· Capital allocation remains an area of focus for the company. They currently repurchase $5 billion worth of shares annually funded 50% by Tencent (he doesn’t specify how much of this is Tencent dividends vs. share sales) and 50% cash.

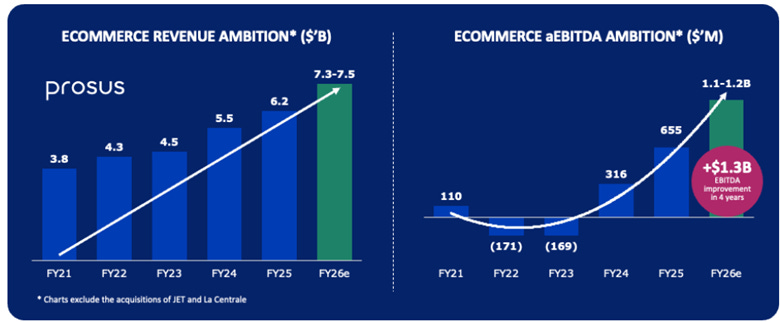

· Reaffirmed Guidance – Bloisi said Prosus will achieve its goal of $7.3 billion in revenue and $1.1 billion in aEBITDA (ex. Tencent) in 2026.

· Bloisi provided an update on Prosus’s major acquisitions in 2025:

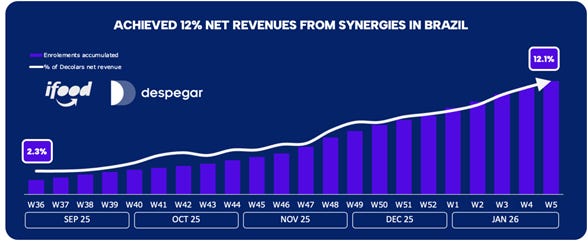

1. Despegar: Despegar is the leading Latin American online travel agency (OTA) which Prosus acquired for $1.8 billion cash in May 2025. Despegar had a strong start to the year with 30% YoY revenue growth in January and improving profitability. 12% of Decolar’s (Despegar’s Brazilian OTA brand) sales now comes from within the iFood app ecosystem.

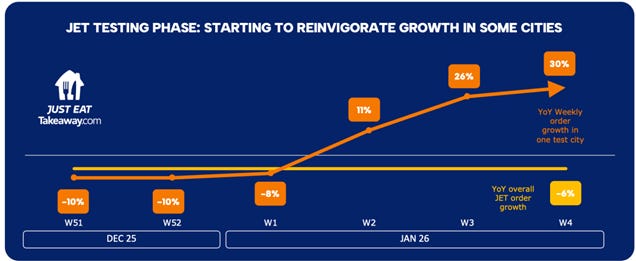

2. Just Eat (JET) – Bloisi spoke about them taking a test group of cities and rapidly testing dozens of different hypotheses to try and boost sales and profitability. This type of testing is straight from the iFood playbook. He said initial results have been promising with “some of these groups showing more than 20% YoY (order) growth”. While these initial tests have been promising, he said JET still had a long way to go to push the company towards consistent revenue growth (overall JET order growth was down 6% YoY) and profitability, which was elusive throughout its history as a stand alone company.

3. La Centrale – “The benefits we anticipated at the time of the La Centrale deal are materializing. We expect growth and profitability to improve as the business becomes more integrated with OLX and benefits from the team’s operational excellence and expertise in technology, product, and AI.” Nothing to add.

· Fierce Competition Across the Portfolio – Bloisi said their businesses operate in fiercely competitive environments. “Prosus is no stranger to competition and is performing very well given the environment.” He provided specific updates on iFood (Brazilian super app) and OLX (global online classifieds app).

o iFood – Bloisi acknowledged that new competitors (probably referring to Meituan) have penetrated the Brazilian market and are offering consumers heavy discounts (and other promotions) to try their products. Bloisi said that while consumers are taking advantage of the promotions, “most” return to iFood once the subsidies end. This is evidence that iFood really does have a superior product, service, experience, ecosystem, and therefore a real sustainable competitive advantage (aka a moat). He said that iFood “will win the strategy/product war, not the subsidy one!”.

o OLX – OLX has been investing in AI innovation for years delivering superior products and services to end users (real estate agents, car dealers, job seekers, and employers/recruiters). “OLX is on track for strong growth and margin improvement this year, with around $450 million expected in EBITDA.”

· Bloisi talked about Prosus’s long-term commitment to AI and being an “AI First” company. “With 37,000 AI agents already deployed across our ecosystem, we’re not just talking about the future of AI - we’re living it every day.”

· He concluded “It has been a busy start to the calendar year with a lot of external noise. I want you to know that, as a shareholder like you, I remain focused on creating real and lasting value at Prosus; by strengthening our businesses and investing in our future.”

While Prosus’s stock is down 14% YTD, other than the recent events at Tencent, little else has changed at the company. They are still on track to hit their revenue and aEBITDA targets for FY 2026, the integration of their major 2025 acquisitions are progressing in line with expectations, and their broader strategy is working. An immediate consequence of the YTD stock price drop is that Prosus will be repurchasing shares at an even bigger discount. Our thesis remains unchanged.

[1] Defined as a 20% drop from recent market peaks

[2] Prosus is Tencent’s largest shareholder and owns 23% of the company

[3] Just Eat, Despegar, La Centrale

[4] This still leaves the door open for opportunistic acquisitions should the right opportunity present itself

[5] Delivery Hero and Meituan most likely